The Telegram channel of the Cheka-OGPU and Rucriminal.info continue the story about another scam by an Israeli citizen, the owner of the BKF bank, Olga Mirimskaya, which she continues to implement in the Tverskoy Court of Moscow directly from the pre-trial detention center, giving deliberately false testimony in criminal case No. 01-0017 / 23 and falsifying evidence on it.

In 2014-2015, two companies received loans worth 600 million rubles from the BKF bank: DOM 21 veka and DekKo +, which were merged under the common Rosstyle brand. Both firms controlled more than 70% of the wallpaper market in Russia and were enviable borrowers of Sberbank, PSB and other major banks.

In 2015, due to a sharp increase in the exchange rate against the ruble, financial difficulties arose in Rosstyle and the company began to look for a way out of the crisis. Vadim Bessonov and Dmitry Noskov, who later turned out to be raiders, promised to help in this. As a result of the intervention of Bessonov and Noskov, Rosstyle went bankrupt, and part of its assets worth several billion rubles came under the control of the notorious Ayub Yakubov.

Due to the bankruptcy of Rosstyle, the BKF bank had a hole in the half of its capital and a violation of the maximum risk standard for one borrower or a group of related borrowers, which threatened to revoke the license. To save it, Mirimskaya and the board of directors of BKF Sergey Orlov came up with a scheme to deceive the Bank of Russia: BKF sold the debts of Rosstyle to the Cypriot offshore companies Mart Capital and Naira Enterprises, owned by Mirimskaya, along the way drawing a paper profit of almost 300 million rubles .

For the debts of Rosstyle, the bank received 90 apartments in the Crimean residential complex "Rielier Chateau" for 800 million and more than 100 million rubles in money. At the same time, for some reason, transactions on behalf of Cypriot offshore companies were concluded by proxy by Mirimskaya’s lawyer, Elena Feskiv, who concurrently was a member of the Board of BKF Bank and was convicted in 2015 of bribing a policeman in Sevastopol for a false certificate for the needs of Mirimskaya. After that, the BKF bank paid for the net statements in the audit office of the Collegium of Tax Consultants and steadily sends them to the Bank of Russia even now.

At the same time, Mirimskaya really wanted to repay her debts again, so she instructed Orlov to organize a criminal case in order to shake off money from the shareholders of Rosstyle outside the bankruptcy procedure. However, a difficulty arose here - according to the documents and reports of the BKF, the debts were sold one and a half times more than their face value, so there was no damage from their non-repayment and, on the contrary, a profit was formed, in connection with which the police consistently refused to initiate proceedings.

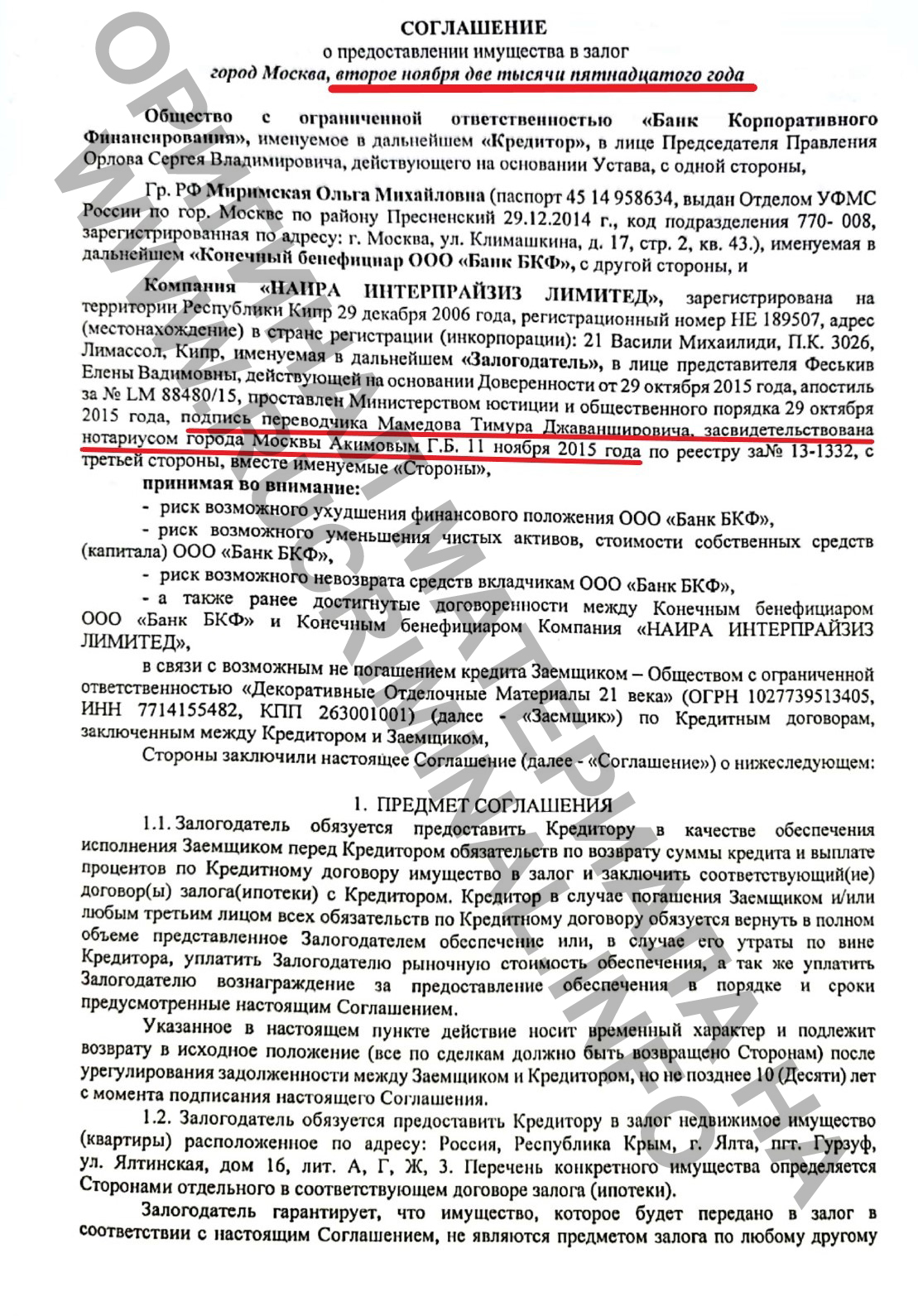

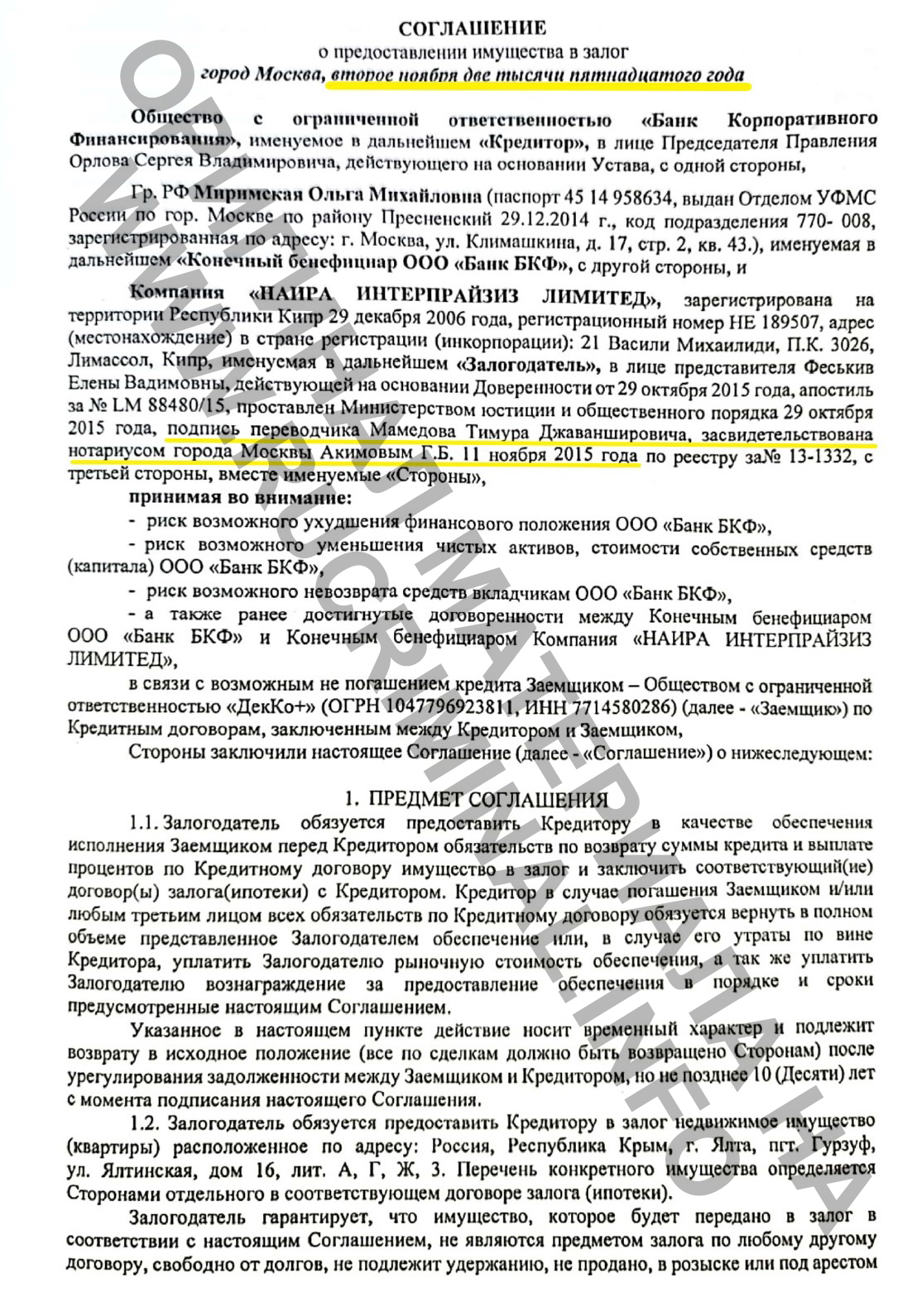

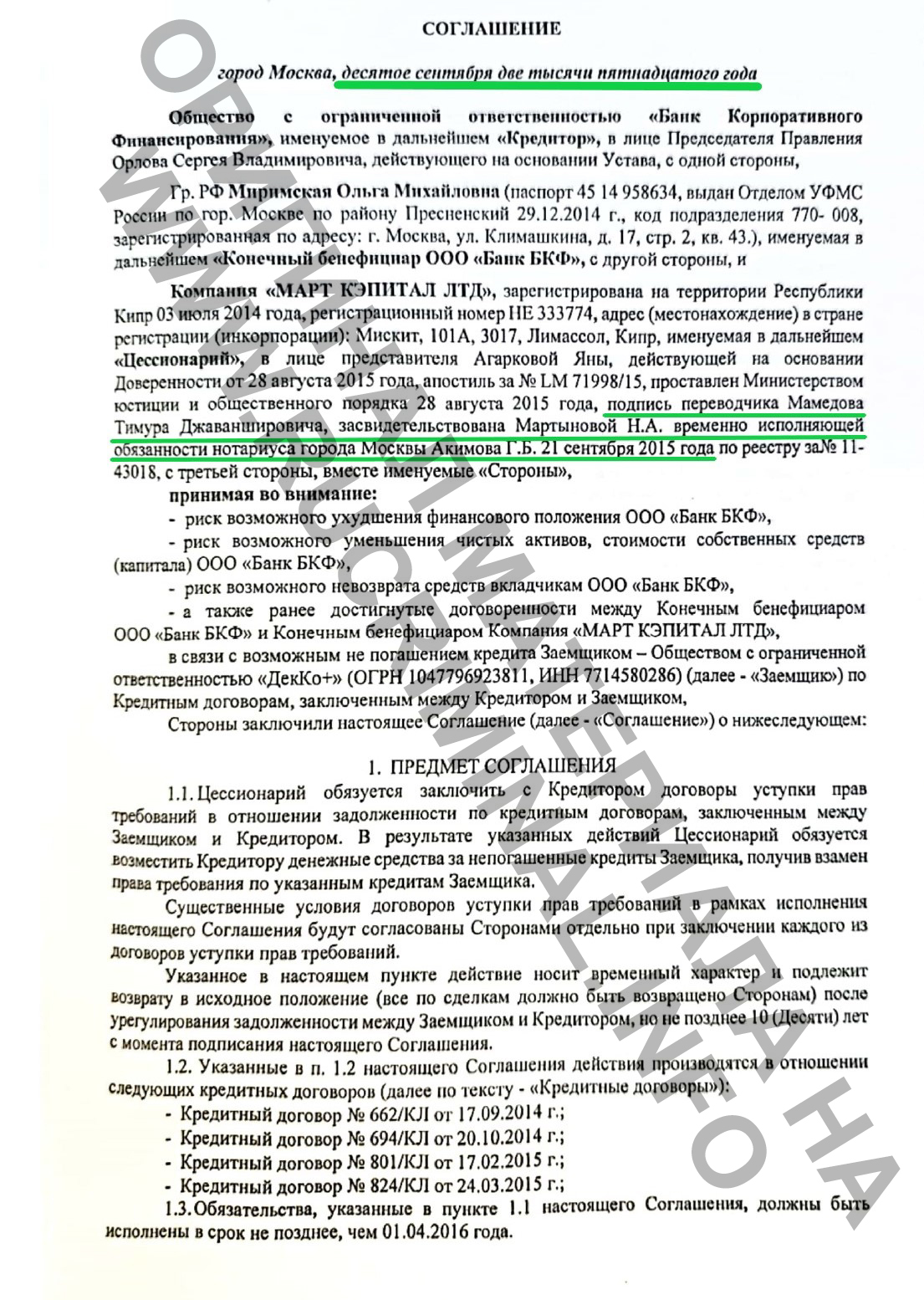

Then Mirimskaya and Orlov again created a scheme: they backdating created alternative agreements with Mart Capital and Naira Enterprises - especially for law enforcement agencies. From the fakes, it followed that BKF should return everything to the Cypriot offshore companies in 2025, paying interest at the same time, and take back the debts of Rosstyle. In this case, pseudo-damage arose.

However, in addition to the fact that these alternative agreements do not appear in the accounts of BKF bank, they also contain frank signs of falsification - the papers were signed earlier than the powers of attorney of the representatives of Mart Capital and Naira Enterprises were certified by a notary, who, to word, there were subordinates of Feskiv, judicial representatives of the "BKF" Anton Nepomnyashchikh and Yana Agarkova. Thus, the Mirimskaya bank retained the license and initiated a custom case. How much it cost and how the evidence was falsified on it, we will tell in the following publications.

Yuri Prokov

Source: www.rucriminal.info